How To Create A Marketing Timeline

It doesn't take long before beginning investors are hit with market lingo like "market price per share" and "book price per share." But what do these terms actually mean, how are they different, and why should you care? Join us as we break down the meanings of both, tell you how to determine them, and how they can be useful information for you as an investor to keep in mind.

Simply put, a stock's market price per share is the price that appears whenever you click on its ticker. If the stock is experiencing a day of heavy volume, the market price per share may literally change by the second as the price fluctuates up and down.

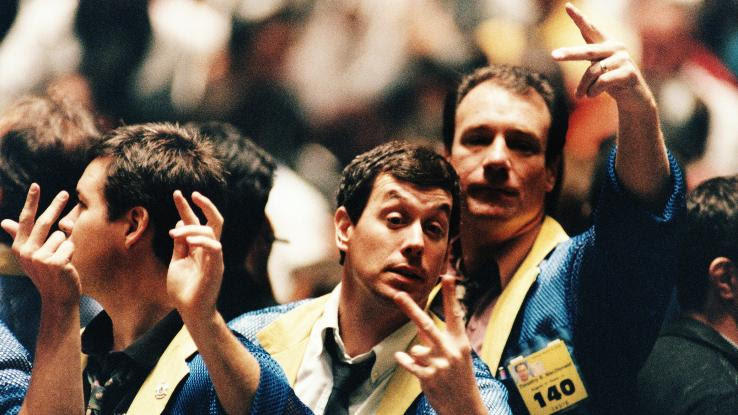

That's because the market price per share is all about supply and demand. In essence, it's the price that the stock is trading for at any given moment. The more people who are interested in buying the stock, the more its going rate will climb. When there are more investors interested in selling their shares than there are those interested in buying them, the price will go down.

Several things can cause a certain company's stock price to move including:

- Things like a great earnings report, a hot new product, a recently approved drug, or a promising new CEO can cause more interest in the company. As more investors buy shares, the stock market's price per share can go up.

- Likewise, bad news can cause a stock's market price per share to nosedive. An unflattering earnings report, a scandal, or a simple lack of interest in the company's products or services can cause sellers to attempt to unload their shares en masse, which drives the price down.

- When it comes to meme stocks or day trading "stocks in play," a stock's market price per share may experience large price fluctuations simply due to volume alone. In these instances, company fundamentals don't tend to matter so much, as the stock price moves simply because a large number of people are trading it at once.

How Is Market Price Per Share Determined?

As we mentioned above, the market price per share is all about supply and demand, which is ultimately what causes it to move either up or down. When you're trading on a web-based platform, it's easy to forget that you're actually more or less participating in an online auction for shares of different companies.

On one side, some people own the shares but are willing to sell them for the right price. That price is called the "ask." On the other, some sellers are looking to buy the shares. The buyers place "bids" on the shares, which is basically a way of saying they'll buy them for a certain price and not a penny more.

The market price per share is the magical moment when a buyer's bid price and a seller's ask price align and a sale is generated. As with any other product, when there's more demand than supplies, prices will be higher. When there's more supply than demand, prices will be cheaper.

How to Use Market Price Per Share to Calculate Market Cap

Want to know the value of a company you're considering investing in? You can use the current market price per share to calculate something called a company's market capitalization or "market cap." This will tell you what the company's overall value is on the stock market and its perceived value as far as investors are concerned.

A company's market price per share refers to the total value of all of the company's outstanding shares put together. Outstanding shares are the shares that the company has authorized to be traded on the stock market and which are held by investors. Outstanding shares are opposed to treasury shares, which are shares still held by the company itself.

To calculate a company's market cap, simply multiply the current market price per share by the number of total shares outstanding. This will tell you how much the company is ultimately worth on the market.

Market Price Per Share Example

Using a company's market price per share to determine its market cap will allow you to understand the size of one company as compared to others, as well as its value on the market at large. For instance, let's say that Company A had a market price per share of $10, while Company B's were currently selling for $5. You might initially assume that Company A had the higher market cap, right? Not so fast!

Say, upon further examination that you discovered that Company A had a total of 10 million outstanding shares. You could calculate their market cap like so:

$10 x 10 million = a total market cap of $100,000,000

Not too shabby. But let's say that you then discovered that Company B had a total of 100 million outstanding shares and used the same formula.

$5 x 100,000,000 = a total market cap of $500,000,000

Ultimately, in the market's eyes, Company B is actually the more valuable of the two.

Market Price Per Share Vs Book Value Per Share

Market price per share is sometimes compared to a company's book value per share, but what is the difference? While the market price per share reflects the current price that shares are selling for, book value per share takes a company's net worth into account.

To determine book value per share you would start with the company's total assets and then subtract their liabilities. Liabilities can include things like debt, overhead, and supplies, etc. The difference between the two reflects what the company is actually worth.

Say, for instance, that Company C's total assets were $100 million, but they were also $40 million in debt. So their net value would be $60 million. Once you arrive at that figure, you'd divide it by the number of Company C's shares outstanding. Let's say in this case that they had 10 million outstanding shares. So:

$60,000,000/ 10 million= a book value per share of $6

Why does this matter? Because comparing a company's book value per share to their current market value per share can be a great way to find growth opportunities. For instance, if company C was currently trading at a market price per share of $2.00, it could be a sign that the company is undervalued and that the current price is a good buy. On the other hand, if Company C's shares were currently trading for $12 per share, you might be a bit more wary because they could be overvalued and destined to correct.

MORE FROM ASKMONEY.COM

How To Create A Marketing Timeline

Source: https://www.askmoney.com/investing/calculate-market-price-per-share?utm_content=params%3Ao%3D1465803%26ad%3DdirN%26qo%3DserpIndex

Posted by: phillipsounins85.blogspot.com

0 Response to "How To Create A Marketing Timeline"

Post a Comment